National Foundation for Credit Counseling® (NFCC®)

Updated Website

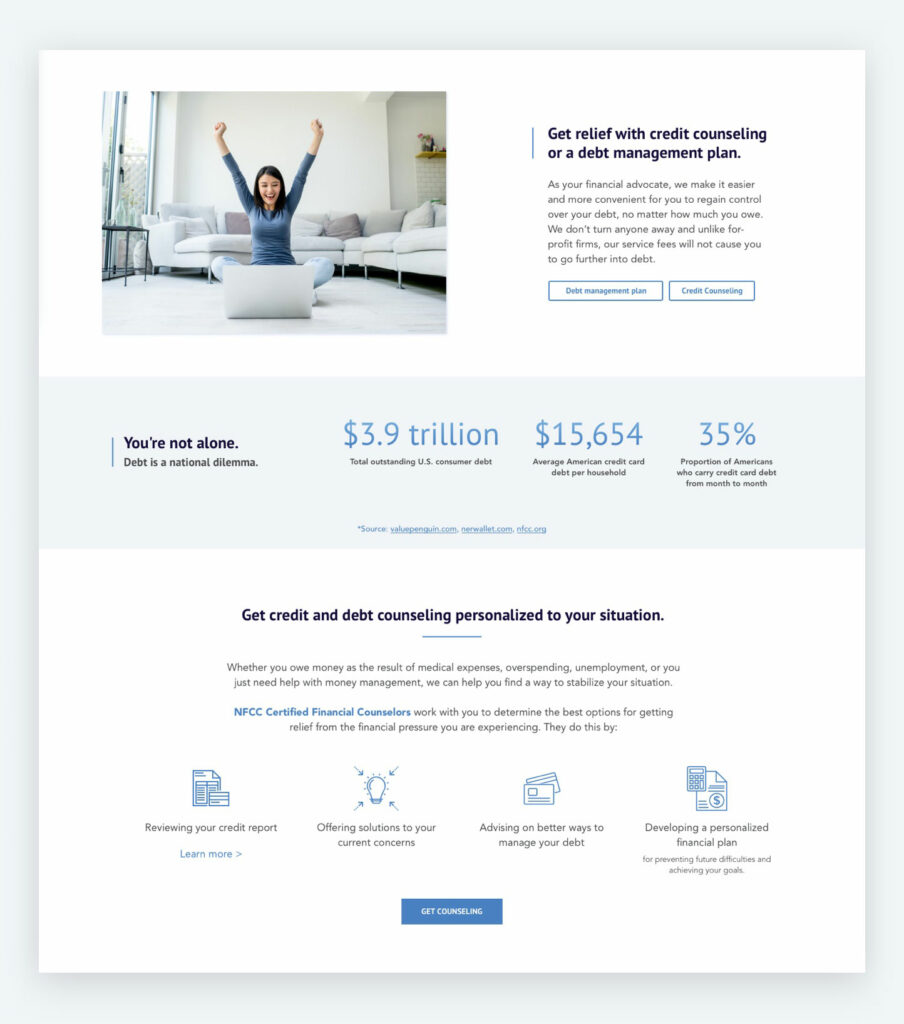

The National Foundation for Credit Counseling (NFCC), the largest and longest-serving nonprofit financial counseling organization in the U.S., needed website update services for a wide range of performance issues occurring on its website. The site primarily served as a link to connect consumers with NFCC’s national network of nonprofit counseling agencies. Due to a mix of older systems and multiple platforms, the site required three different technology partners to maintain and only managed a 40% uptime. From a credibility standpoint, this was especially troubling as the NFCC introduced a new set of initiatives and student load debt services in competition with “for-profit” agencies providing less comprehensive services.

Choosing the Right Marketing Agency Partner for a New Website

NFCC was aware of our long history in financial services marketing. It’s not always easy choosing a digital marketing agency for website updates and maintenance, but as they evaluated our capabilities and website upgrade services, they also understood we had the proficiencies needed to collaborate with multiple vendors and outside resources to deliver the integrated solution for their situation, all while honoring ADA site compliance requirements.

Gaining Alignment on Digital Goals and Strategy

It was imperative to get all stakeholders and contributors into alignment. We organized website service-design and workshop discovery sessions that included internal NFCC stakeholders, external agency stakeholders, and technology partners. These sessions outlined goals and new website requirements that led to a plan for an MVP (minimum viable product) site that could be slowly and strategically expanded.

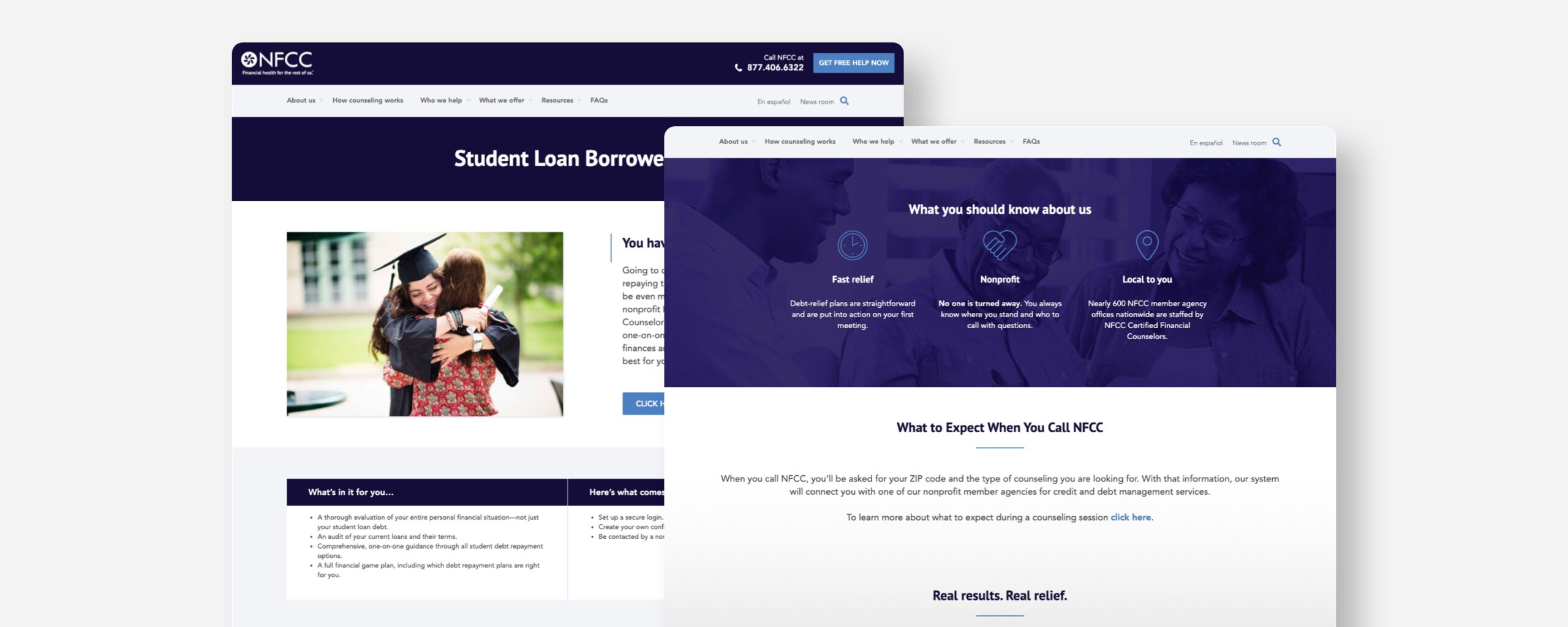

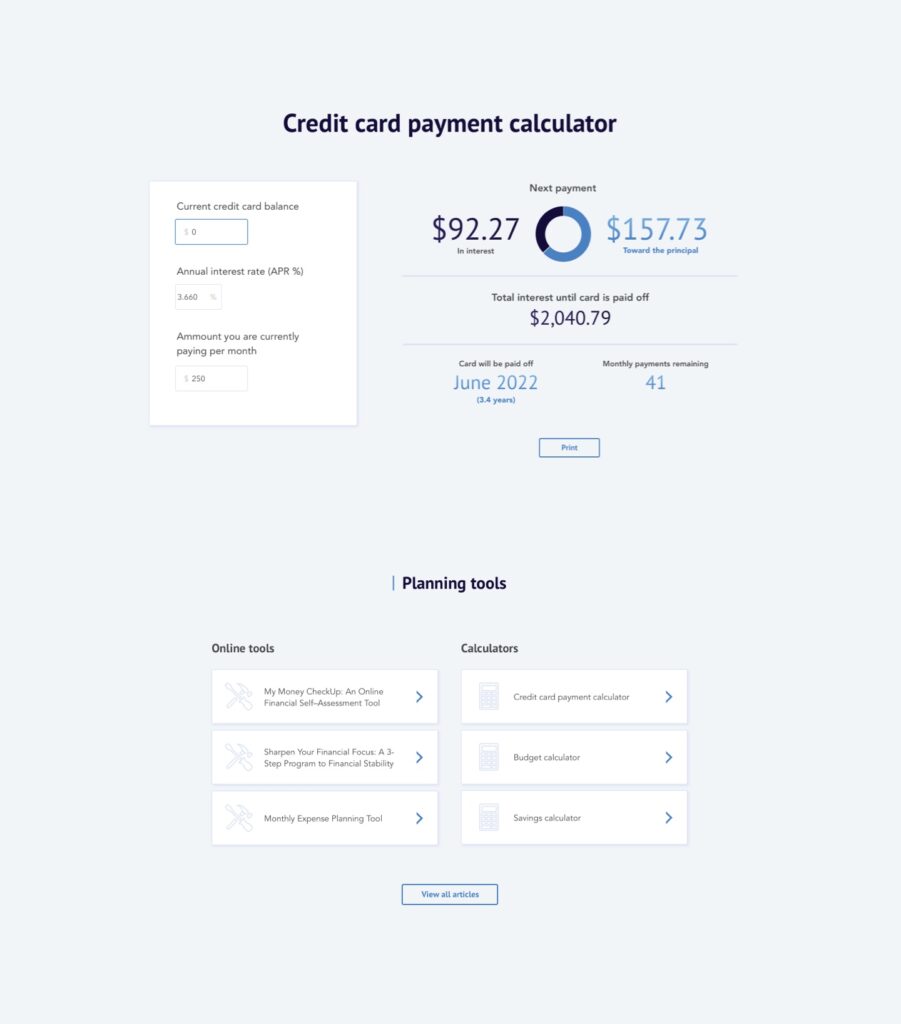

A Staged Buildout of Multiple Digital Solutions

We redesigned and reorganized hundreds of pages of copy and rebuilt the nationwide counseling agency locator. In partnership with other technology partners, we rebuilt the site’s lead generation and workflow. We helped migrate the site’s front-end systems into the NetSuite CRM platform. Another important element in upgrading the website was reimagining how the site could work to better engage consumers, government agencies, grant writers, and donors and help them learn about the NFCC. When complete, it was a fully ADA-compliant website.

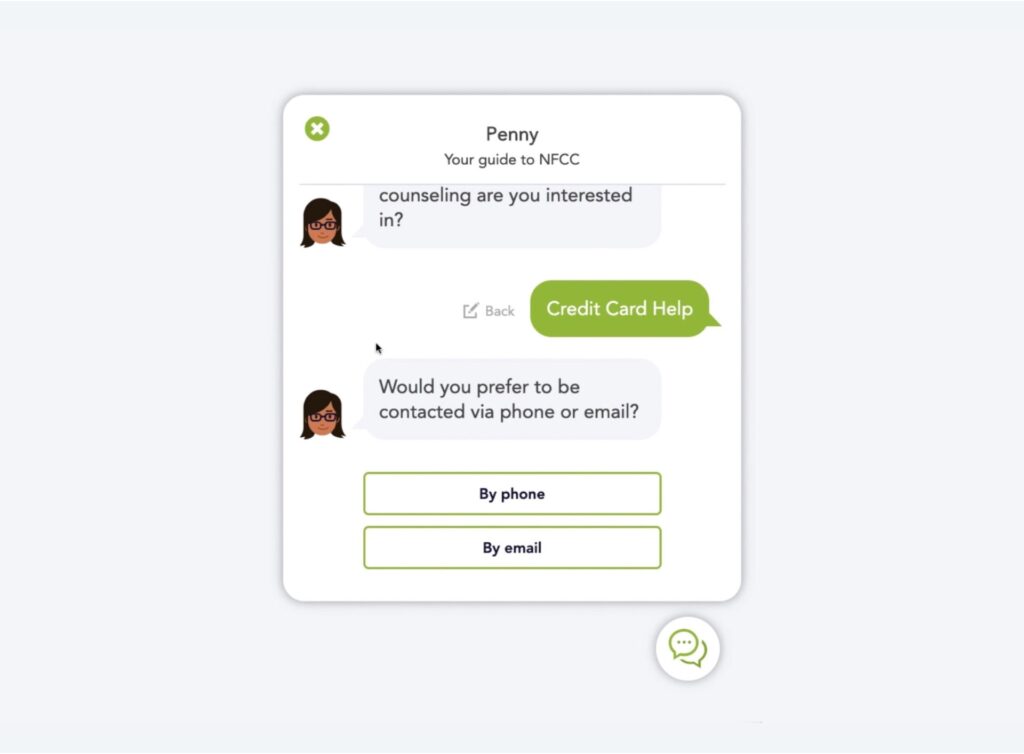

“Penny”: A Custom-Designed, Friendly Chatbot

In our discovery sessions with key stakeholders, we learned that consumers are uncertain about how to engage with credit counseling. So, through our chatbot services, we custom-built “Penny”, a friendly and engaging chatbot online. Penny was designed to help answer common user questions by directing them to educational resources, as well as make direct connections between users and member agencies in NFCC’s network.

Easy to use, empathetic, and always available, Penny’s welcoming experience was quickly adopted by new and repeat customers.

Need help getting started?

Share this Case Study